Are payments and “chat” the same thing?

When you think of what “chat” is, many of the daily chat experiences that immediately come to mind – your favorite social network, or the group chat app you use to keep in touch with friends and family all over the world – are open-ended, free-form, and informal.

And of course, these kinds of conversations do drive powerful human connections and build engaged communities at massive scale, all day, every day. However, the teams behind the world’s leading apps are betting on a more expansive view of “chat” that can power easier, more intuitive transactions for their users. Letting go of limiting ideas of what chat is or can be unlocks massive opportunities.

Expensify recently added open-source financial group chat to its growing roster of financial services, stating “every payment is a structured chat to resolve some kind of debt tension that exists between two people.” In other words, payments and chat are the same thing.

Communicate seamlessly with buyers.

Let’s consider that for a moment: every financial transaction evolves from a conversation between two entities. When you forward an invoice, you’re basically sending a message to someone saying that you need payment for products or services rendered. When the receiver accepts your invoice, they’re replying to your message by transferring the required funds.

A key distinction between regular conversations and the kind that drives financial transactions is the format of the chat. Whereas regular conversations are usually conducted in a more unstructured and free-form way, financial chats are more narrowly-construed and focus on specific steps needed to conduct smooth payments.

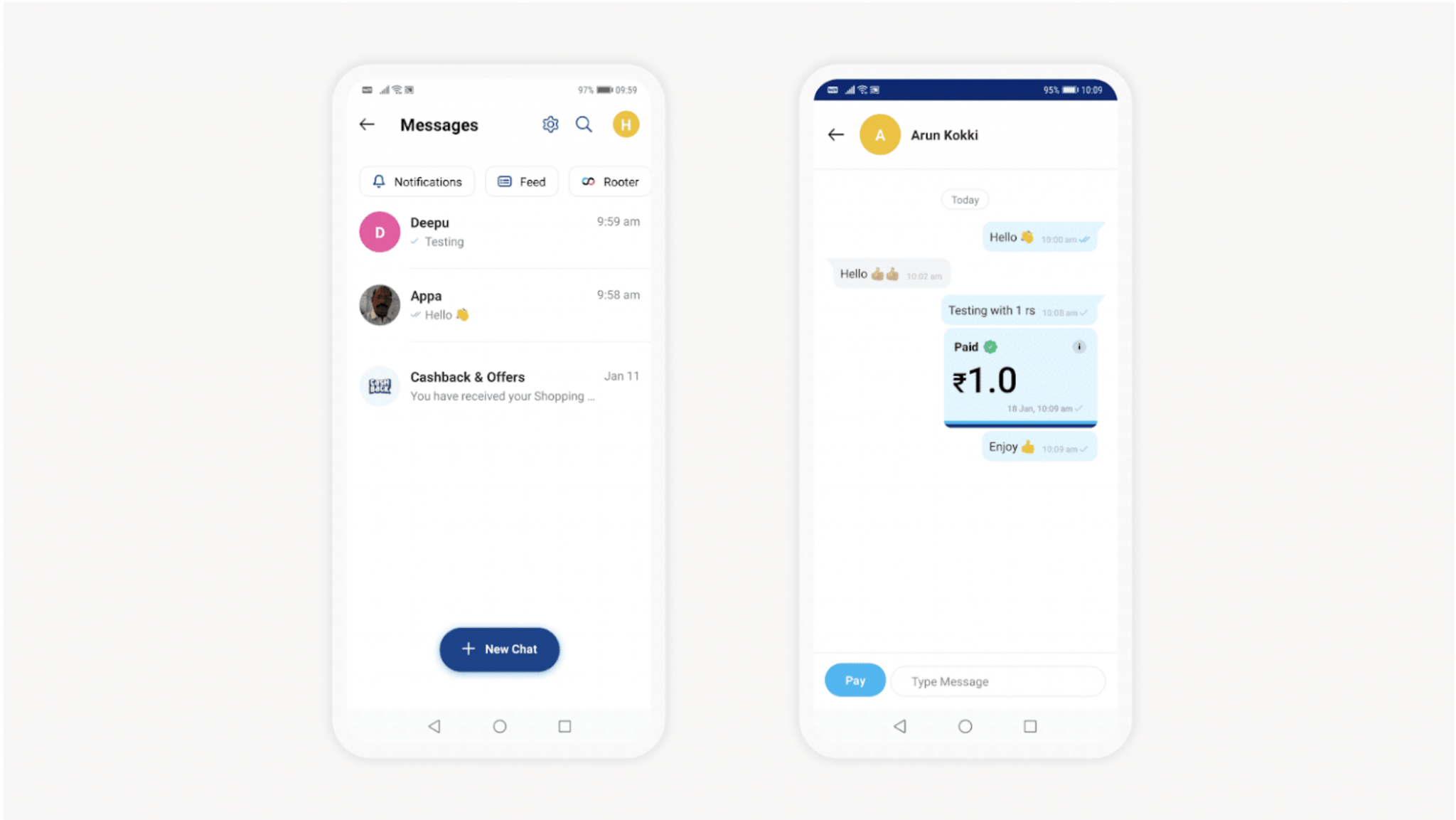

Cutting-edge companies like Paytm have built a “chat powered payments and engagement platform [that] represents a change in how users look at transaction history.” Here, Paytm has invested in what it calls an “identities-first approach” where users can simply tap on a contact’s profile and instantly see a clear view of who they are, conversations discussed, what payments were made, when they occurred, and for what purpose.

These actions link deeply within Paytm’s money transfer suite and allow for a convenient and rich experience for end-users, entirely contained within the company’s ecosystem.

Aphra Behn, a 17th-century dramatist from Britain, once famously said: “Money speaks sense in a language all nations understand.” While not all conversations are about money, all monetary transactions begin with some form of conversation. Offering chat-based payment capabilities within your mobile app provides users a single persistent transaction record they can rely upon, alongside the relevant context of the surrounding conversations.