AI in finance: 24 examples of how AI is used in finance and banking

AI is reshaping the financial sector, heralding a new era of data-driven decision-making, efficiency, security, and customer experience. Driven by promises of streamlined operations, reduced costs, and improved customer experience—investment in AI continues to surge.

According to Statista, adoption of generative AI in finance reached 52% in 2024. Yet, another Statista report found that only 33% of organizations saw gains in efficiency or customer experience—highlighting a growing need to bypass the hype and practical outcomes.

This raises questions: how is AI used in finance? Where is it delivering real value?

This article highlights the 24 top AI use cases in finance. Each includes real-life examples of AI in finance from industry leaders to help you make the right strategic AI investments.

What is artificial intelligence (AI) in finance?

AI in finance refers to the use of machine learning (ML), deep learning, and predictive analytics to analyze data, automate processes, and enhance the decision-making of financial organizations.

Capable of analyzing and leveraging vast datasets in real time, AI improves the speed and precision of financial services and operations. It can enhance everything from customer service to forecasting, risk management to fraud detection, investment strategies, and more.

How to use AI in finance

AI is rapidly reshaping the finance industry, making it more efficient, secure, and customer-centric. By integrating AI tools into existing operations, finance organizations can reduce costs, streamline operations, and set a new standard in customer experience.

The core types of AI used in finance are currently:

Generative AI (GenAI)

According to Statista, 52% of financial organizations are using generative AI as of 2024, up from 40% in 2023. GenAI can be used to automate much of customer communications, support, and account management. Using natural language processing (NLP), GenAI tools deliver accurate, relevant answers to customer queries at scale in the form of chatbots. These tools can meanwhile analyze customer sentiment, generate reports and summaries, surface insights, or serve as virtual assistants to employees to enhance decision-making and efficiency.

AI-powered predictive analytics

AI-powered predictive analytics use machine learning algorithms to analyze historical and real-time data to forecast future trends, assess risks, and optimize financial strategies. Using predictive analytics, finance teams can move beyond manual efforts and reactive decision-making into more proactive, data-driven, efficient approaches across various functions.

AI agents for finance

The next frontier of intelligent automation in finance is AI agents. These autonomous applications can reason, process data in real time from multiple sources, and execute complex tasks from start to finish without human intervention. They can be used to automate customer service, enhance security, streamline backend operations, and personalize financial services and operations.

24 AI in finance examples

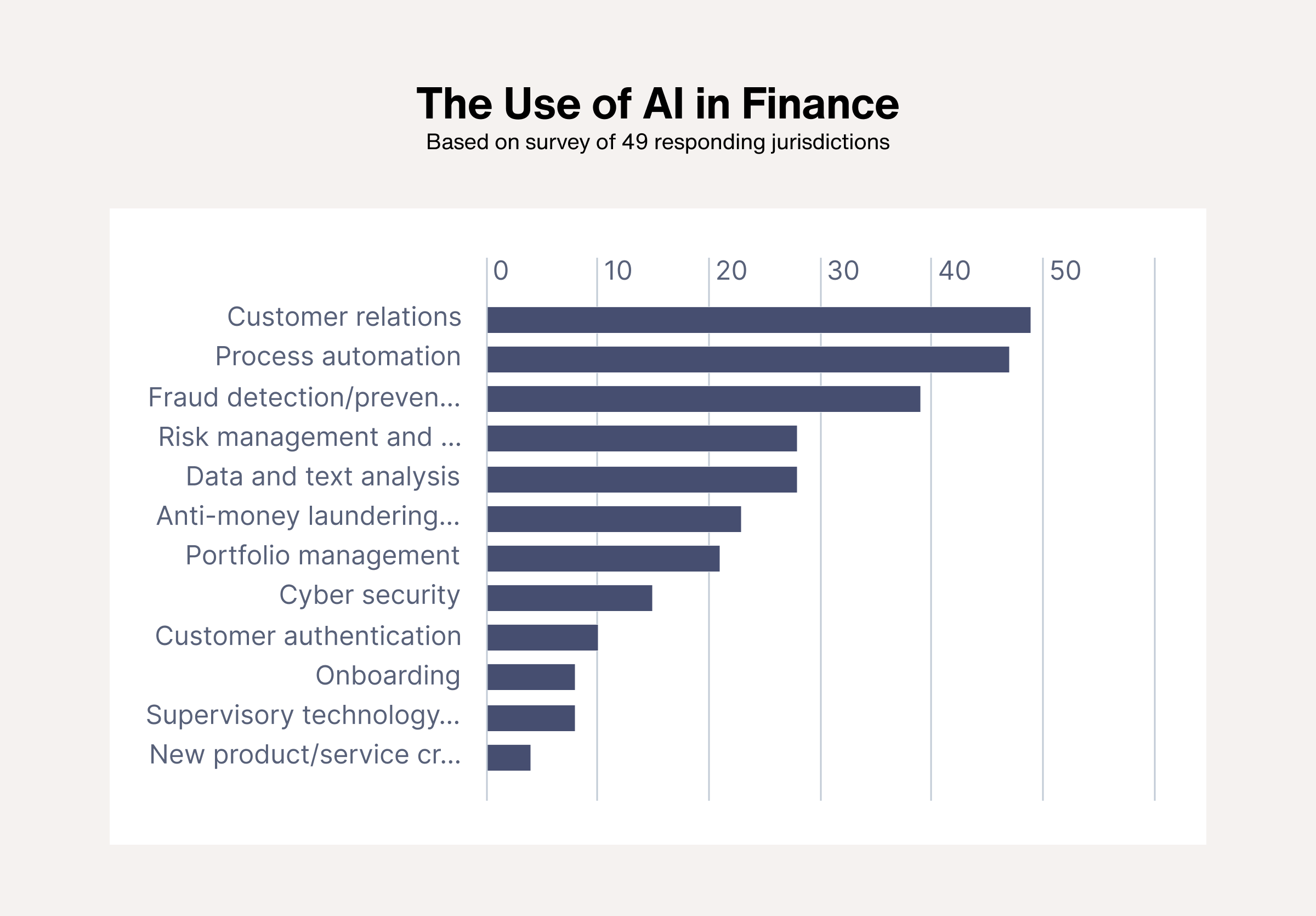

With AI adoption in finance increasing, a recent survey shows its most common AI use cases in finance are in customer relations, process automation, and fraud detection.

In the following sections, we’ll explore AI in finance examples from financial leaders that align with these top use cases, including:

Customer experience and personal banking with AI

A full 89% of customers use mobile apps for banking, so the digital experience has never been more important in finance. Meanwhile, 41% of customers say they want more personalized banking experiences and information.

This section highlights five AI use cases in finance with real-life examples of how AI improves front office operations.

1. Automated customer service with AI chatbots

AI chatbots for finance provide 24/7 customer support on mobile apps, websites, chat, and other digital channels. Using natural language processing (NLP), they provide contextually relevant, tailored responses for customer self-help that automates much of account management. For example, chatbots can handle account inquiries, process payments, assist with loan applications, or provide tailored financial advice.

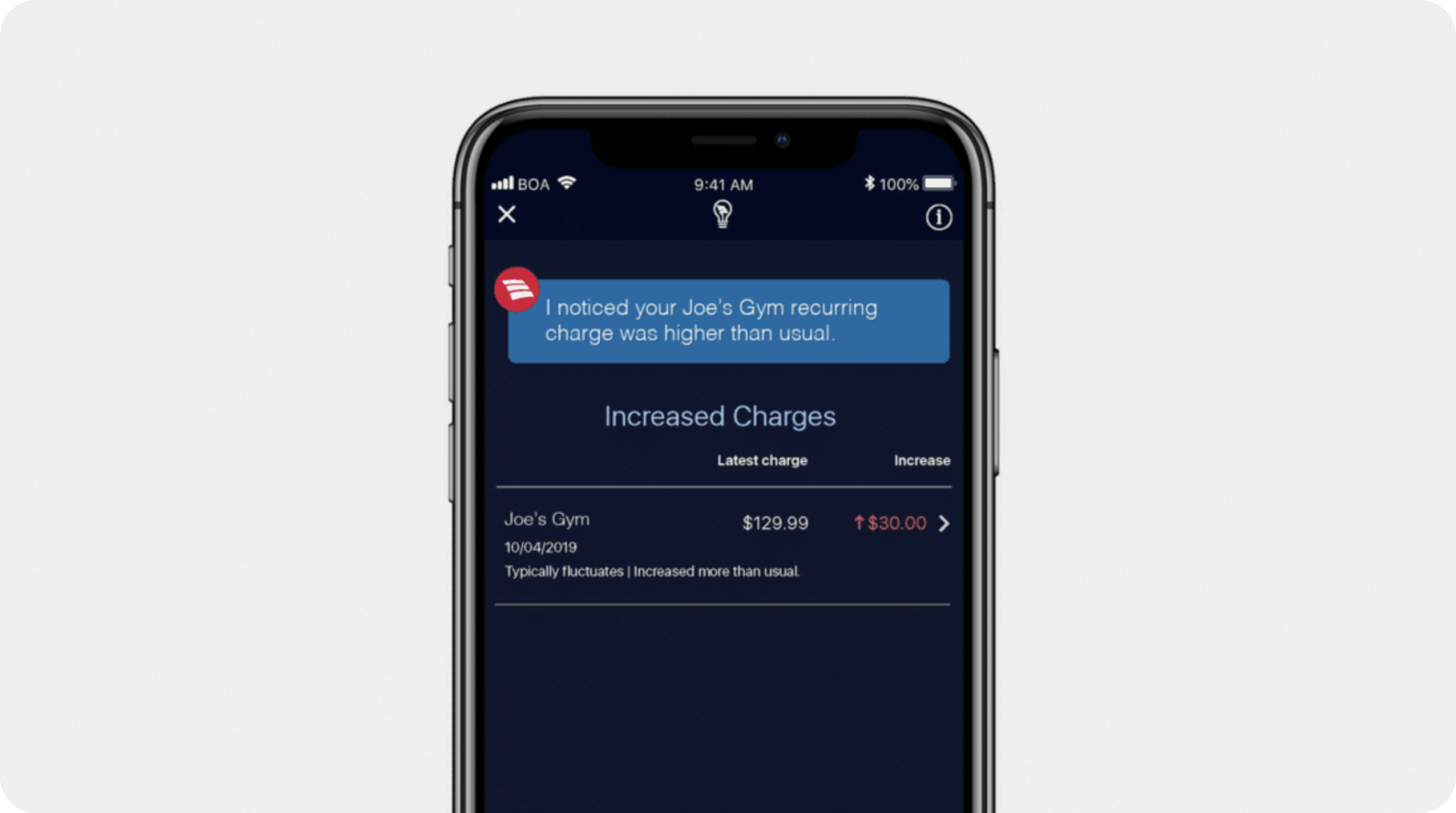

✅ Example: Bank of America’s chatbot, Erica, helps customers check balances, execute transactions, and get personal financial insights—even sending proactive alerts to customers when unusual transactions appear in accounts.

Learn more: AI agent vs chatbot: Key differences explained

2. Personalized financial advice from AI advisors

AI is an effective way to scale high-quality customer interactions, and another popular use case is personalized financial advice via AI robo advisors. AI models analyze customers' spending habits, savings, and investment behavior to identify patterns and trends and provide tailored financial recommendations 24/7 that align with current market conditions and stated financial goals.

This enhances the customer experience, adding a new layer of convenience and confidence to digital banking experiences that customers appreciate.

✅ Example: Wealthfront, an AI-powered robo-advisor, helps customers optimize their investments based on risk tolerance and financial goals.

3. Voice-enabled conversational AI

Another way to create more convenient, tailored financial experiences is with voice-enabled conversational AI. Using NLP, voice-enabled AI assistants enable customers to ask banking questions and perform a growing list of transactions—check balances, pay bills, or transfer money—all via voice command.

This gives customers a more effortless way to manage their money, upgrading CX while also freeing employees to focus on complex tasks to boost productivity. Conversational AI can also be deployed in call centers to automate workflows, tailor service interactions, and elevate CX.

✅ Example: Bank of America’s Erica is an AI-powered voice-enabled virtual assistant that enhances customer experience and streamlines banking operations.

4. Hyper-personalized offers

AI can deliver tailored offers for financial products to customers based on historical data and, thanks to AI agents, real-time context. Machine learning (ML) predicts when customers might need a loan, credit increase, or investment options based on existing data.

AI agents go a step further, monitoring current in-app behavior, chat conversations, or market conditions and proactively triggering offers based on historical data and real time context. This automates the delivery of the most relevant offers to better drive marketing performance, sales, upsells and cross-sells.

✅ Example: American Express uses AI to personalize credit card offers to customers.

5. Seamless omnichannel experiences at scale

AI concierges seamlessly integrate across existing tools and AI systems, acting as the connective tissue for omnichannel engagement and support. Unlike gen AI chatbots, AI agents enable truly seamless cross-channel engagement by storing customer interaction data in memory.

This allows them to maintain context between interactions, and hold one continuous conversation with customers that spans channels—creating a delightful sense of continuity and removing friction to elevate the omnichannel customer experience (CX).

✅ Example: Capital One integrate AI across multiple touchpoints for a smooth CX.

Automate customer service with AI agents

Process automation with AI in finance

For all its front office upgrades, AI is equally effective at creating operational efficiencies, reducing costs, human error, and streamlining operation. For example, one study found AI can reduce the time it takes to complete tasks by up to 40%.

These next six AI use cases in finance show how AI enables financial organizations to do more with less.

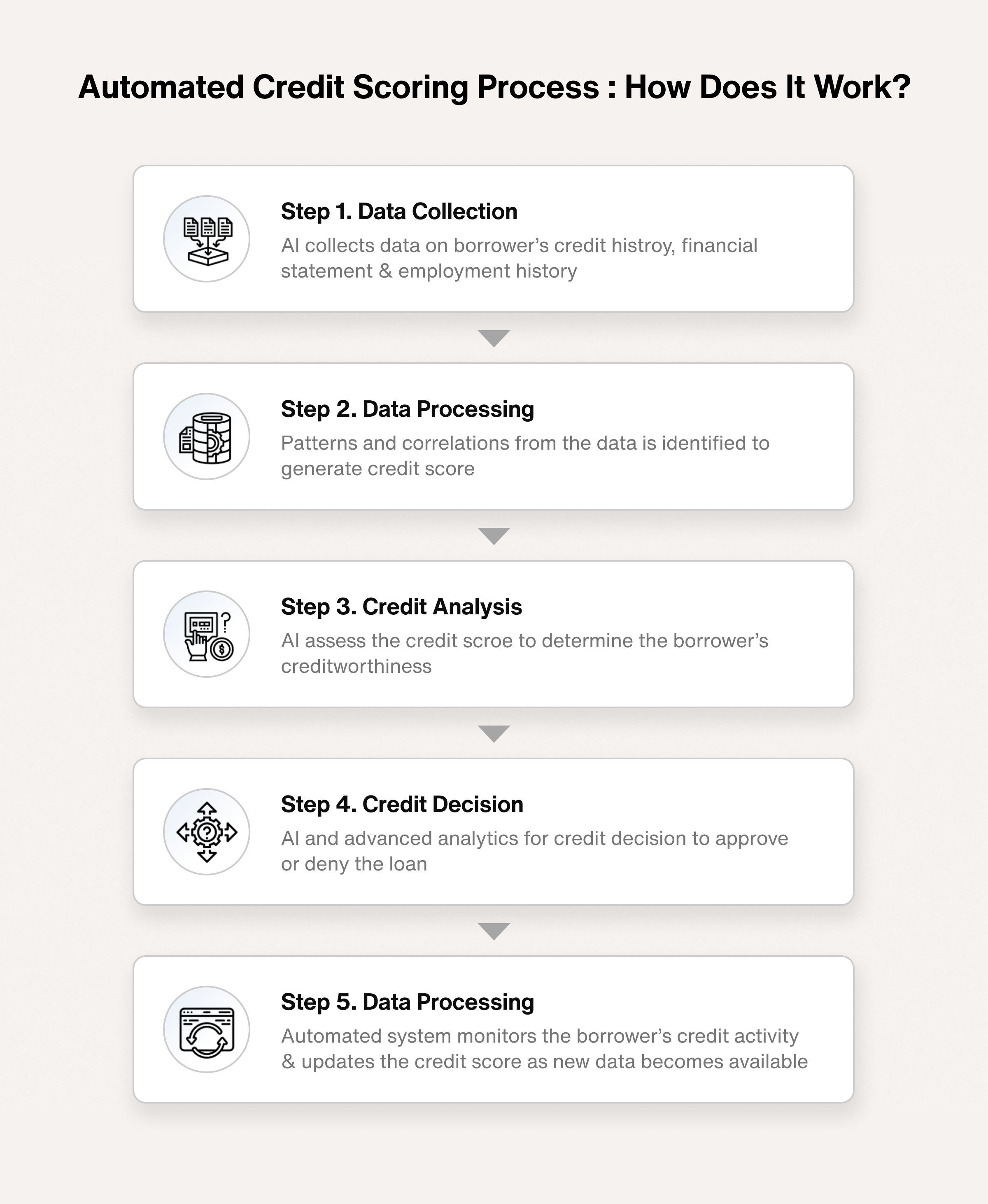

6. AI-driven loan applications

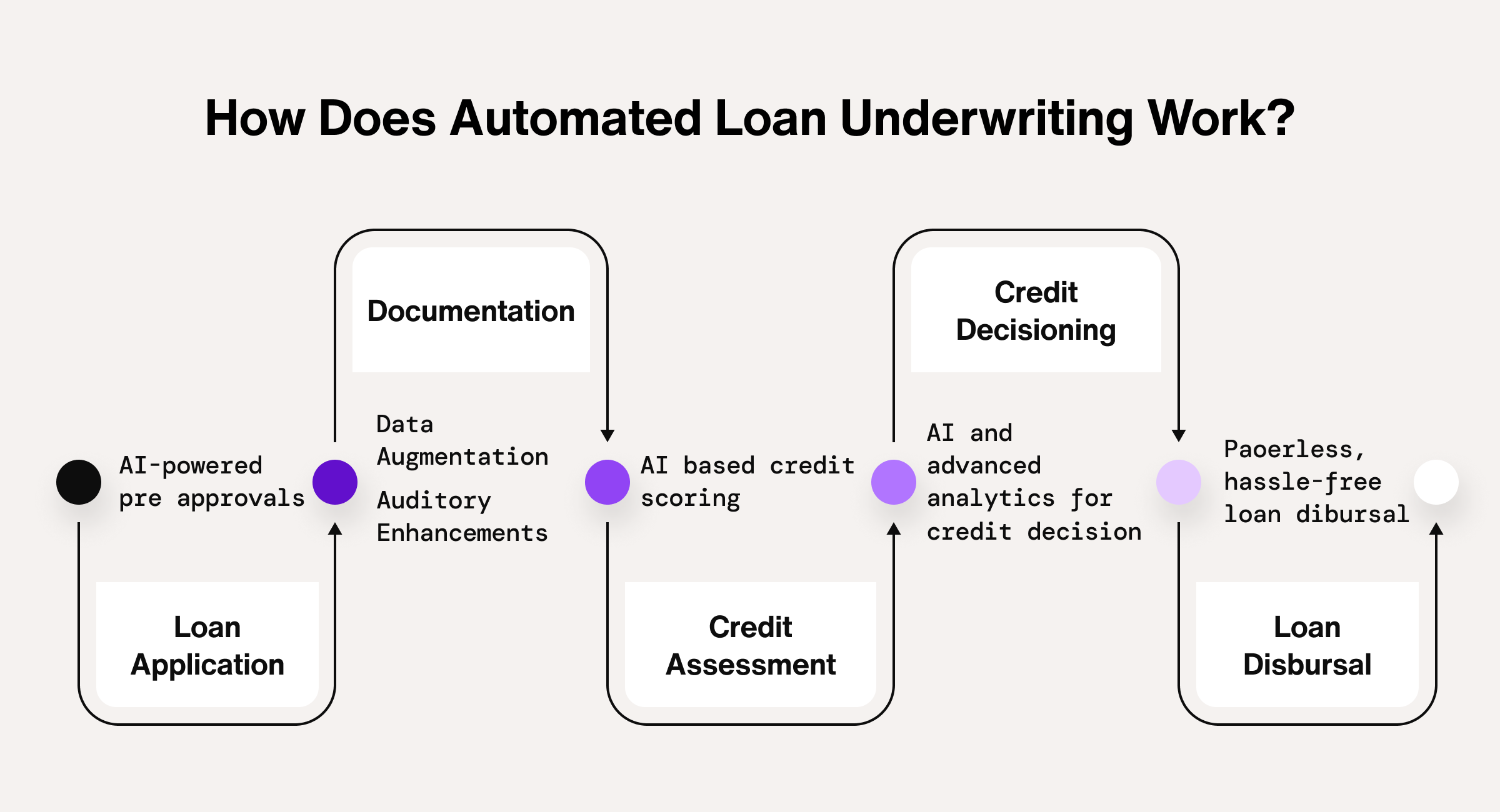

AI accelerates the loan approvals process while improving its accuracy, helping reduce loan risk by up to 70%. Neural networks and ML can quickly analyze an applicant’s financial history, alternative credit data, and transaction patterns to assess creditworthiness in seconds and reduce default rates. AI agentic workflows can automate loan underwriting processes while staying compliant with relevant regulations and policies to mitigate risk.

✅ Example: ZestFinance uses AI to aggregate, analyze, and process data from multiple sources in real time to automate loan underwriting.

7. Automated reporting with robotic process automation

Another AI example in finance is using robotic process automation (RPA) to automates variety of repetitive and rule-based tasks. This includes processing loan applications, handling account reconciliations, and generating regulatory and financial reports. By reducing the time and effort needed to produce financial documents, RPA both reduces costs and human error as it improves employee productivity and morale.

✅ Example: Deutsche Bank uses RPA to automate back-office processes like compliance reporting and transaction reconciliations.

8. Document processing with AI in finance

AI-powered OCR (Optical Character Recognition) technology extracts and processes structured and unstructured data from documents, then ML algorithms analyzes, searches, and stores this data for document-intensive processes. For example: loan servicing, investment research, invoicing, mortgage lending, credit scoring, know your customer (KYC) verification, and more.

Even with human verification at the end, using AI to process financial documents helps to reduce manual data entry, errors, and accelerate financial workflows while mitigating risk.

✅ Example: JPMorgan Chase’s COIN (Contract Intelligence) automates the review of legal documents, saving 360,000 hours of human work annually.

9. Automated data reconciliation

AI automates the matching of financial transactions across systems, ensuring records are kept accurate and consistent for real-time use, and making the month’s-end closing process for banks more efficient. AI models can identify and flag potential errors or discrepancies in the process of cleansing, standardizing, and validating transaction data.

This helps financial institutions to improve their data accuracy, leading to improved compliance reporting, risk management, and insights into performance.

✅ Example: Xero, a cloud-based accounting platform, uses AI to automate transaction reconciliation and improve financial accuracy.

10. AI-driven image recognition

AI like computer vision and deep learning models can quickly and accurately process and derive insights from images and videos. This enables financial organizations to accelerate insurance claim processing, damage assessments, check processing—even expedite customer onboarding with KYC-compliant identity document verification.

✅ Example: HSBC uses AI-driven image recognition to automate check processing, improving efficiency and reducing fraud.

11. Speech recognition AI for call center automation

AI can quickly convert audio to text using NLP, providing a faster way to evaluate customer calls and improve services. By transcribing customer calls automatically, AI reduces the need for manual reviews, saving time for service teams while identifying patterns like common issues or customer sentiment. This helps to generate insights that improve training, quality assurance, and the service experience in a targeted way.

✅ Example: JPMorgan Chase uses speech recognition AI to enhance internal operational efficiency and improve call center productivity and improve customer service.

Empower your support agents with AI

Fraud detection and prevention with AI in finance

Thanks to AI in finance, fraud detection and prevention has never been more accurate, effective, and efficient. By analyzing datasets and continuously monitoring transactions in real time, AI models can identify patterns and anomalies that suggest fraudulent transactions, financial crime, and trade spoofing with unparalleled speed and accuracy.

In fact, more than 7 in 10 banks now use AI to detect fraud, as AI algorithms reduce detection time by 90% compared to traditional methods.

Here are three AI use cases in finance with real life examples of fraud detection and prevention.

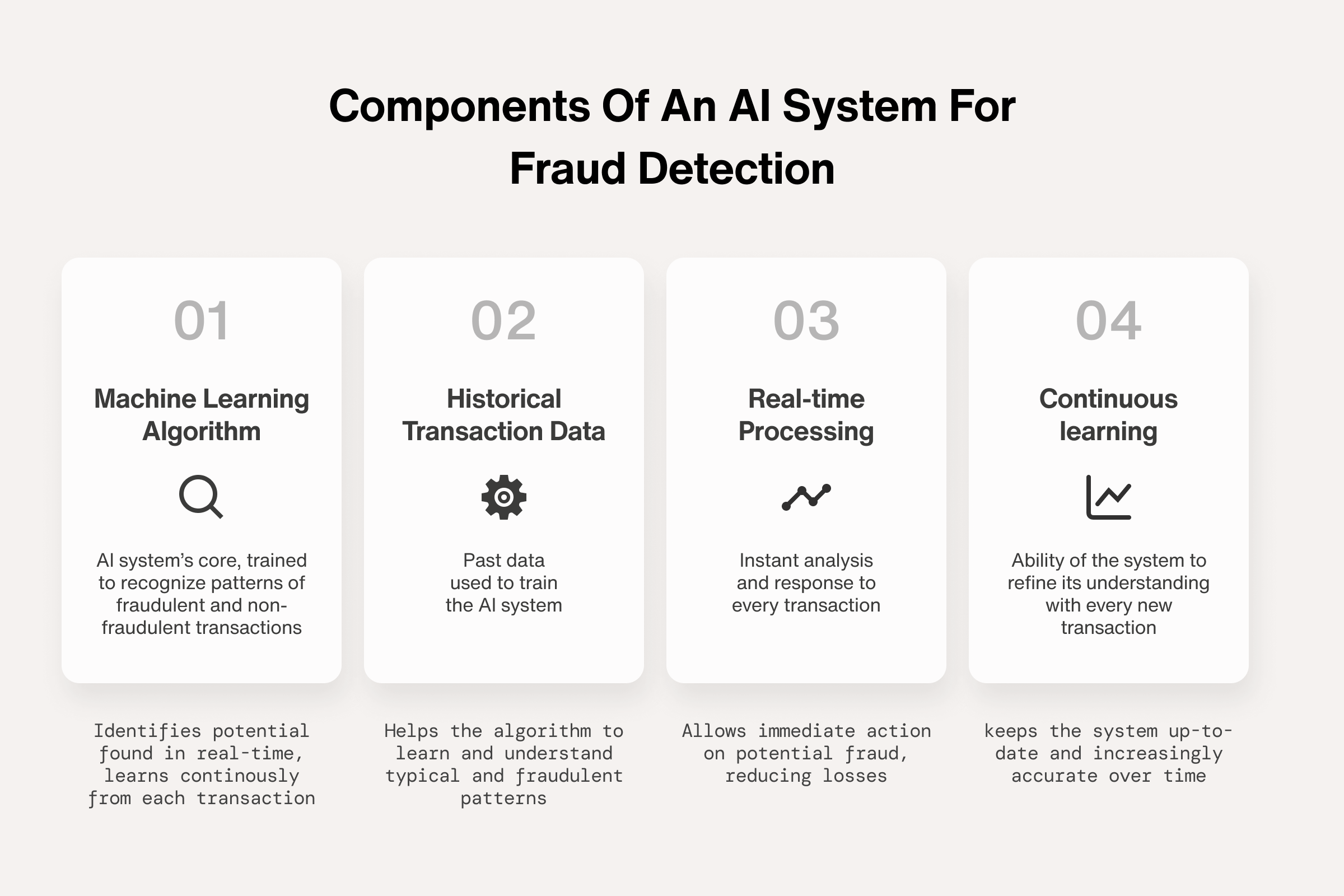

12. Real-time fraud detection and prevention

AI-powered fraud detection systems not only detect fraud in real time, they proactively act to stop it. ML algorithms spot unusual spending patterns, login attempts from unrecognized devices, and sudden changes in transaction behavior. Meanwhile, AI agents proactively trigger fraud prevention measures such as two-factor authentication or access controls. This enables a proactive, always-on approach to fraud prevention, halting fraudsters in advance to protect against financial loss, risk, and reputational damage.

✅ Example: PayPal uses AI to scan millions of transactions for fraudulent activity. The system flags anomalies and prevents fraudulent transactions before they occur.

13. Behavioral analysis

AI can also assess behavioral traits like typing speed, mouse movements, login times, or how users hold their smartphones to detect fraudulent activities. And if a transaction is attempted in an abnormal manner, the system can trigger additional authentication or block the transaction for the suspect user—without impacting the user experience at large.

✅ Example: BioCatch uses AI-driven behavioral biometrics to detect fraud in digital banking transactions by identifying unusual patterns in user behavior.

14. Anti-money laundering (AML)

AI enhances AML efforts by continuously monitoring financial transactions and identifying suspicious patterns or anomalies linked to money laundering. AI agents can pull in data from outside sources via APIs in real-time—like sanctions screenings or adverse media mentions—improving accuracy and reducing false positives compared to traditional rule-based AML systems.

✅ Example: HSBC uses AI-driven AML systems to monitor billions of transactions and reduce false positives while improving fraud detection accuracy.

Leverage omnichannel AI for customer support

Financial forecasting and data analysis with AI

If knowledge is power, AI is a kingmaker. AI models trained to recognize patterns and make calculations can process vast sets of historical data, market trends, and alternative sources in real time, enabling a deeper understanding of current market behaviors, greater agility, and more informed decision-making.

AI confers a massive informational advantage, so it’s no surprise that, according to an NVIDIA survey, over 90% of financial services companies are either assessing or already using AI.

Here are two AI use cases in finance for financial forecasting and data analysis with examples.

15. Data analysis

Machine learning algorithms with big data analytics can analyze huge datasets and extract insights much faster and more effectively than humans. This enables financial organizations to automate much of market research and data analysis, enhancing everything from risk management to trading strategies to decision-making with deeper, more comprehensive business intelligence.

✅ Example: Goldman Sachs uses AI-driven data analysis to pull insights from stock markets, news articles, financial reports, and more to enhance decision-making, risk management, and more.

16. Financial planning and forecasting

AI models can forecast financial trends like revenue, expenses, and cash flow with unparalleled accuracy. They do this by synthesizing data from multiple sources to identify patterns, risks, and trends to inform financial plans and models. This enables predictive models to anticipate market changes, investment performance, and drive smarter decisions that minimize risk and maximize returns.

✅ Example: LendingClub uses AI-driven predictive models to assess borrowers and mitigate risk before approving loans.

Reinvent CX with AI agents

Risk management and compliance with AI

AI’s ability to process large datasets in real time and detect patterns means it can more accurately mitigate risk in credit lending, identify verification, and cybersecurity.

Agentic AI, which integrates seamlessly across business systems, can then automatically compile data to maintain compliance across systems.

Here are four AI use cases in risk management and compliance with real examples from top financial institutions.

17. Credit risk analysis

AI improves the accuracy of credit risk analysis by incorporating alternative data sources such as social media behavior, online purchase history, and utility bill payments. Unlike traditional credit scoring that relies on FICO and similar scores, AI enables lenders to assess creditworthiness for people with little to no credit history, reducing risk while driving transactions. It’s estimated that using machine learning to assess a more comprehensive range of data points will help lenders to cut losses by 23% annually.

✅ Example: Upstart, an AI lending platform, assesses borrowers based on their education, employment history, and spending habits rather than just credit scores.

18. Regulatory compliance automation

Financial institutions must comply with a variety of ever-changing regulations, and AI is a boon to the RegTech stack. AI automates compliance monitoring by analyzing transactions, contracts, and reports, detecting potential regulatory violations, and reducing manual auditing efforts.

✅ Example: IBM Watson assists banks by analyzing regulatory changes and ensuring adherence to financial laws.

19. Automated identity verification

AI speeds up the process of Know Your Customer (KYC) verification, using ML to analyze and authenticate identity documents, transaction history, IP addresses, and more. By automating the process of investigating if an applicant's information is being used legitimately, AI helps financial institutions prevent identity theft and fraudulent account activity without adding to workloads.

✅ Example: Onfido uses AI-powered facial recognition and document verification to streamline digital identity checks for financial institutions.

20. AI-powered cybersecurity

Agentic AI can continuously monitor network traffic and financial data to identify anomalies that suggest a cyber attack, then respond to threats in the moment. This enables real-time threat detection and response that significantly enhances the cybersecurity posture of financial institutions.

✅ Example: JPMorgan Chase uses AI-powered cybersecurity tools to protect infrastructure from cyberattacks by monitoring network traffic for unusual patterns.

Delight customers with AI customer service

Trading, investment, and portfolio management

In money markets where nanoseconds can be the difference between opportunity and regret, AI’s ability to turn patterns in datasets into strategic, split-second trades can lead to a competitive edge.

What’s more, AI algorithms can analyze data and execute trades far faster than human traders—even up to 90% faster than non-AI tools.

Here are three AI use case in finance with examples of how it leads to faster and better trading decisions.

21. Algorithmic trading

AI is a boon for stock trading, especially algorithmic and high-frequency trading. For example, AI algorithms can analyze historical and real-time market data to execute split-seconds trades at optimal moments, adjusting trading strategies in real-time based on customers’s financial situation, market conditions, even news events. This increase in trading speed and precision helps organizations to capitalize on fleeting opportunities and maximize returns.

✅ Example: Renaissance Technologies, a hedge fund, uses AI-driven algorithmic trading to identify patterns and maximize profits.

22. Portfolio management

By analyzing a vast array of market conditions and economic indicators, AI helps investors and financial institutions to make better decisions and optimize their portfolios. It helps investors to manage portfolios by recommending asset allocations that maximize returns while minimizing risk, and adjusts portfolios automatically based on market conditions and customer goals.

✅ Example: Betterment uses AI to help investors build and rebalance portfolios based on market changes.

23. Market sentiment analysis

AI-driven sentiment analysis can identify the main emotions or opinions in a text or audio recording, adding a valuable point of data to inform decision-making, financial modeling, CX improvements, and investment strategies. By scraping various sources such as news articles, social media, or earnings reports, AI can gauge public, investor, or customer sentiment with accuracy in seconds. This enables organizations to gauge the prevailing perception in response to key events, or in key areas, and make more informed decisions going forward.

✅ Example: Dataminr provides AI-driven real-time alerts on financial news events that could impact stock markets.

Benefits of AI in finance

Automation – AI streamlines workflows, enhances security, and personalizes banking experiences.

Accuracy – Reduces manual errors in data processing, analytics, and customer interactions.

Efficiency – Frees employees for strategic work by automating routine tasks like document verification.

Speed – Processes vast data quickly, improving decision-making, risk modeling, trading, and compliance.

Availability – Enables 24/7 financial management and support via cloud-based AI.

Innovation – Unlocks new financial products and services through predictive analytics.

Personalization – Delivers tailored financial insights, proactive recommendations, and seamless digital experiences to enhance customer satisfaction and engagement.

Next steps: Using AI in finance

In finance, the next leg of the digital transformation hinges on AI. In the words of PayPal’s chief AI offer, Asim Tewary:

“As I think of it, AI will just go away and become pervasive like an operating system.”

For all its potential, AI is complex. It helps to create a well-considered AI strategy that accounts for factors like explainability, transparency, risk, and compliance while also defining the key applications and use cases

If you’re looking for help with creating your AI strategy and deploying AI agents, Sendbird can help. Our team of AI experts includes machine learning engineers, data scientists, and more are skilled and ready to help enterprises craft and deploy an effective AI strategy at scale.

Our robust AI agent platform makes it easy to build AI agents on a foundation of enterprise-grade infrastructure that ensures optimal performance with unmatched adaptability, security, compliance, and scalability. Contact our team of friendly AI experts to get started.

If you want to learn more about the future of AI, you might enjoy these related resources: