Let's talk about money: Why conversational banking is the future

We’re experiencing a sea change in the banking and financial services industry. The rise of new fintech products and services, such as the recent social+ wave, has changed consumer expectations. Therefore, legacy financial organizations must change how they interact with customers and deliver services to stay ahead of the game. After all, it’s no secret that institutions which provide the best customer service will come out ahead. How will financial services organizations deal with this? After all, traditional support and chatbots no longer cut it. Banks need a new way to deliver efficient and personalized services.

Enter conversational banking! Conversational banking is the key to delivering a top-notch customer experience. Let’s explore how you can leverage this new method to fuel business growth.

What exactly is conversational banking?

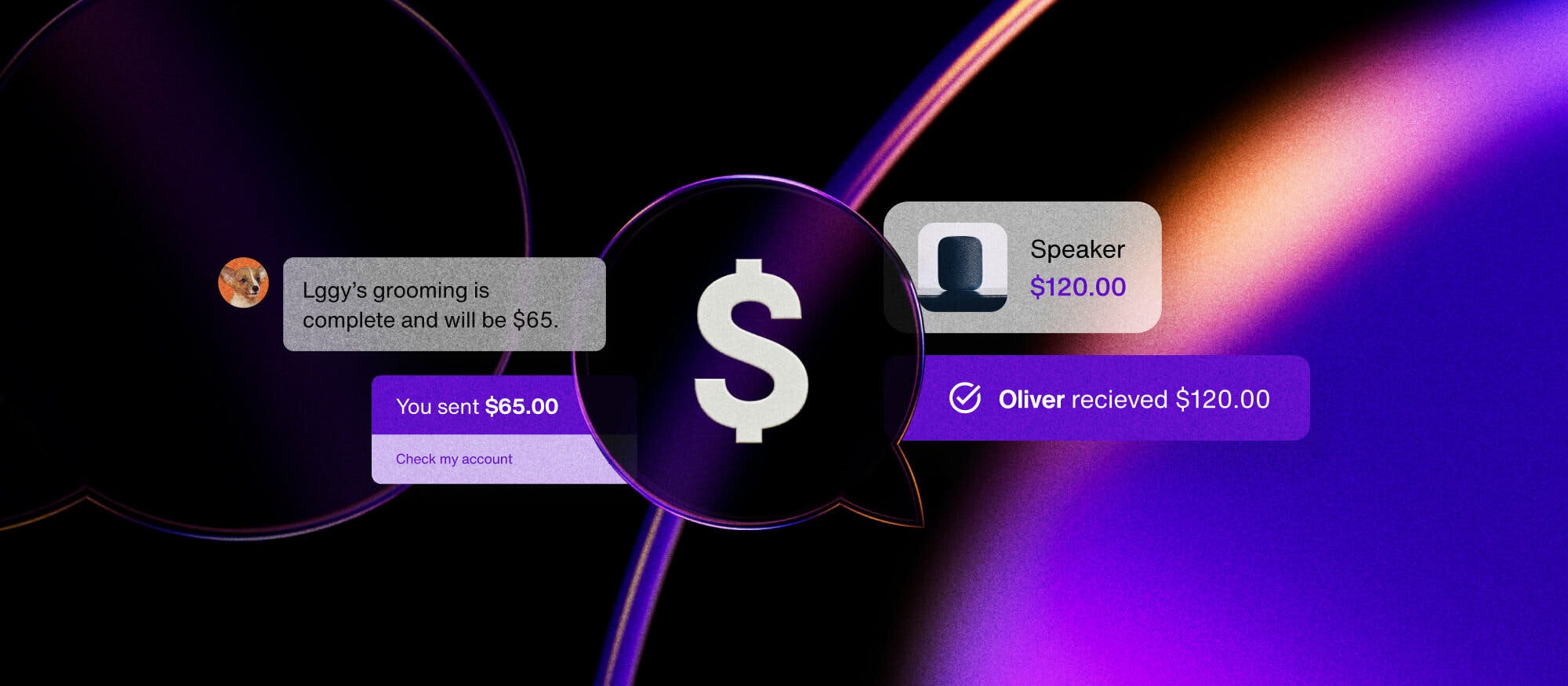

Conversational banking is the delivery of banking services through various communication channels, such as voice calls, text, messaging, voice assistants (e.g., Siri, Alexa), mobile apps, video chat, and other visual engagement tools (e.g., co-browsing, screen sharing.)

Conversational banking allows customers to interact with banks through their preferred channels, from anywhere and at any time. Meanwhile, customer service teams can access customer data such as demographic information, profile preferences, financial behaviors, and goals to provide personalized advice and recommend relevant products and services.

Regardless of channels and formats, the core of conversational banking is understanding customer needs and providing the most relevant services. This is done through real-time, dynamic interactions that combine the speed and accuracy of AI-powered technologies with the personal touch of human agents.

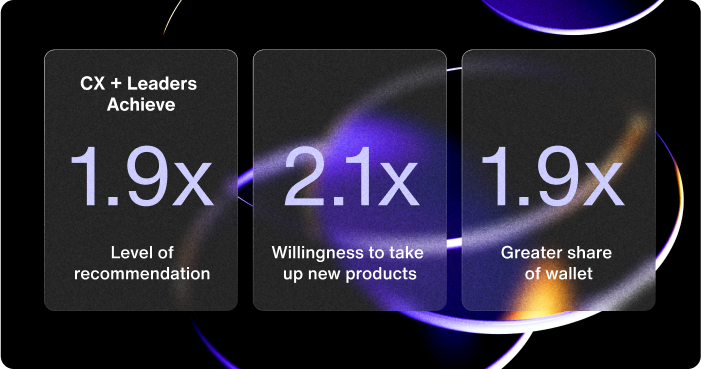

Conversational banking allows you to nurture customer relationships through digital channels. You can create a bespoke experience that makes every customer feel special—and therefore more likely to stay loyal and use more of your services.

What’s wrong with the old way of banking?

The old way of banking, where everything is transactional, no longer meets consumer expectations. Your customers don’t want to be a faceless number in your database. They will switch to another bank if they don’t get the relationships and communities they expect.

Traditional communication channels can’t provide the real-time interactions consumers want in this age of instant gratification. If your customers need an answer right away, they won’t tolerate waiting 48 hours for someone to reply to an email, and then another 24 hours to for a follow-up question to be addressed.

At the same time, fewer and fewer consumers tolerate phone support where they’re put on hold for what seems like forever and can only get help when the call center is open. Moreover, voice-only interactions don’t allow agents to share a link, send a file, or use screen sharing to walk a customer through a process.

What about self-service channels that deliver information instantly? These solutions are a step up, but they confine users to choosing from a list of standard inputs. What if they have further questions? Users are back to square one—waiting for someone to pick up the phone or respond to their email inquiries.

AI and chatbots are a further consideration. While we have come a long way with AI tech, chatbots alone can't deliver the engaging experience and dynamic conversations that consumers expect. Moreover, chatbots can’t grasp the nuances in human interactions, which can be critical when discussing sensitive financial issues.

Consumers want to solve their financial challenges and get their questions answered in minutes—not hours or days—with minimum time and effort. They don’t want to visit a branch or navigate rigid online tools with limited capabilities. It’s apparent that the old ways of delivering customer services often create unsatisfactory banking experiences that don’t meet today’s demand.

This is where conversational AI in banking comes into play.

The benefits of conversational banking

Conversational banking can help you to cost-effectively deliver a modern customer experience by combining AI and chatbot technologies with human agents. Here’s how it can give you a competitive edge.

Responsive 24/7 customer support

Users can get round-the-clock customer support from anywhere. Meanwhile, system integration and automation technology streamline many processes to shorten the time to resolution, as well as reduce frustrating errors and delays.

Proactive customer engagement

You can reach out to customers proactively based on their activities on your website, mobile app, or other touchpoints to offer personalized advice and recommendations. These interactions can help you improve customer satisfaction and loyalty.

An omnichannel customer experience

Consumers expect to interact with brands via multiple touchpoints and pick up where they left off even if they switch channels halfway through a conversation. The right technologies allow you to deliver a seamless omnichannel experience across multiple touchpoints.

Reduction in customer support costs

Conversational banking helps automate manual and repetitive tasks (e.g., answering simple questions) so your agents can focus on resolving complex issues and building customer relationships without driving up costs.

Personalized banking experiences at scale

Customers want services customized to their unique needs. Conversational banking allows you to leverage innovative digital solutions to deliver personalized banking experiences at scale, even during peak hours, without adding to your operating costs.

The best of both worlds

Conversational banking combines the speed and convenience of self-service features with the human element of traditional customer support. You can build emotional connections with customers without compromising the speed and accuracy of your services.

Security and fraud prevention

AI tech in conversational banking can support fraud detection by identifying anomalies. For example, you can use a customer’s voice as an authentication factor when delivering services through voice assistants.

How to implement a conversational banking strategy

There are many ways to use conversational banking to improve the customer experience:

Increase speed and efficiency with AI and automation technologies

Build trust and nurture relationships with video calls

Deliver a convenient experience with messaging

Use co-browsing and file sharing to support remote collaboration

Enhance customer onboarding with video chat and screen sharing

But how do you put them together? Here are the key steps to crafting an effective conversational banking strategy:

Identify customer touchpoints

Map your customer journey to understand how customers interact with your business. Then, create a strategy to engage customers effectively across all the touchpoints to deliver a seamless and consistent omnichannel experience.

Gather frequently asked questions

Find out the most common queries from your customers. You can use or build a chatbot to answer simple and repetitive questions to streamline the customer experience while freeing human agents to handle more complex issues.

Add human interactions

Identify potential points of friction where human agents can resolve issues more effectively to minimize frustration. Make the right tools (e.g., video chat) easily accessible to ensure that customers get the help they need when they need it.

Establish a single source of truth

Store all your customer data in a centralized location (e.g., a customer data platform) and integrate the system with all your customer touchpoints to inform personalized, real-time customer interactions.

Ensure privacy and compliance

The use of multiple channels could increase the attack surface of your systems and networks. Protect your customers’ personal data by implementing technologies that meet various compliance standards, including ISO 27001, SOC 2, and GDPR.

Build lasting relationships one banking transaction at a time

The rise of mobile apps in the finance industry means that delivering a seamless in-app messaging experience is a must-have if you want to tap into the power of conversational banking.

The good news is that you don’t have to reinvent the wheel to deliver a bespoke, personalized customer experience while upselling and cross-selling additional services.

Sendbird’s in-app messaging solution for financial services supports secure real-time customer interactions via messaging, voice calls, and video chat to help you offer timely customer support and personalized advisory services. Our robust API allows you to seamlessly integrate our UIKit with your existing systems and touchpoints.

Try Sendbird for free to see how you can implement conversational banking to stay ahead of the curve.